Or as I subtitle this post: There is no alternative to gentrification.

Many people feel very strongly that there is an inherent evil in gentrification. They think that there is something inherently wrong in people with money spending it on real estate. Nevermind the hypocrisy latent in the gentrification arguments, because today I want to present a different argument. The truth this that Rust Belt cities have no choice but to gentrify. If they don't they will die.

In the 1970s many big industrial cities saw their employment base deteriorate as factories began the process of shedding workers and closing doors, hitting the old big cities hardest. These cities, in turn, did not make the best fiscal choices in hindsight. Many of them chose to try and absorb the unemployment by increasing the number of city workers. However, overall compensation was too generous - especially in terms of health benefits and pension obligations. This bloated workforce began to saddle cities with insurmountable debt. Increased workers saddled taxpayers with higher taxes. However, the glut of workers were largely unproductive, resulting in city dwellers paying more and getting less. So they starting leaving, carving the tax base up. And why not, its a free country.

In the 70s New York was on the brink of receivership and contemplating shutting the subways down. But then, something happened. That something was computers. In the 70s, Wall Street shut down on Wednesday to process all that paperwork. With the rise of computers and spreadsheets, Wall Street could vastly expand business, staying open 24/7. The increase in financial services brought new wealthy workers into the city looking to jump the competition and live in a close commute downtown. These so called yuppies of the 80s started the process of turning around New York's real estate, bringing much needed property tax revenue to the city.

Today the process is so complete that it is hard for many people to believe that New York was once a Rust Belt dump.

In contrast with this is the city of Flint. The city of Flint did not gentrify. It did not attract a class of wealthy young people who wanted to live downtown. Instead it squandered money chasing tourism. And then, later, it basically died. Flint's water crisis is but the final sad swansong for a city that was not able to gentrify. It is really not much different than many small cities around Chicagoland such as Harvey that have seen their tax base dwindle and have not been able to recalibrate their finances. Spending isn't cut and the old property tax payers are squeezed with higher assessments. They flee and the city begins the death spiral to receivership. Thus Harvey ends up owing the city of Chicago millions in water fees that it cannot possibly repay. Sound familiar? Rust Belt cities that lose too much of their tax base soon run into problems with basic city services like providing clean drinking water.

Detroit started to gentrify really only about ten years ago. It wasn't in time to bring much needed property tax revenue to the city. Without that the city, which like so many others had too many pensioners for the shrinking tax base, went into receivership. Dishonest writers make meretricious arguments like the city is too big or had a "strange geography". The answer is quite simple; an eroding tax based caused the city to raise rates on existing residents and businesses, which hastened their withdrawal. It can happen anywhere, really. Today, thanks to the influx of wealthy young people, hipsters, and gentrifiers, the city is increasing its property tax revenue enough that it can invest in some much needed building projects; like fixing the roads, the schools, and implementing 21st century policing. Is it enough? Is Detroit doing enough to encourage gentrification and new development?

Chicago began to gentrify much later than New York, but much sooner than Detroit. Today it sits in a precarious middle. Many poor neighborhoods in Chicago generate very little in property tax revenue. Many 3 flats I've canvasses pay less than $4000 a year in property taxes. New 100 unit condos on the northside pay that much a year per unit. This influx of development for hipsters, gentrifiers, and wealthy elite are what keeps the lights on in this city. As much as you and I might hate them for their loathsome tastes and attitudes, and as much as we might resent them for making much of the city completely unaffordable, they are also the reason that the city can run buses and trains all night and build new schools and pave the roads and send out police in squad cars that don't break down regularly. These assholes are the reason Chicago hasn't already gone into default like so many other Rust Belt regulars.

So at the end of the day there is no alternative to gentrification. What else is Chicago supposed to do to avoid going into receivership or failing at very basic city services like clean water? Has anyone proposed a serious alternative? Nope!

Chicago Urbanist

Examining Chicagoland one brick at a time

Thursday, June 14, 2018

Wednesday, October 15, 2014

Walkable urbanism in the South Suburbs: not for a lack of trying

Previously I pointed out that there is a high degree of variance in the real estate markets of Chicagoland, and that the rising tide hasn't lifted everyone equally. The south suburbs in particular have not faired well compared to suburbs equally north. If you'll allow me to quote myself:

And while Chicago did very well last year, with home prices showing their biggest advance in 25 years, the south suburbs have done very poorly. Prices in many south suburbs have declined to 1990s levels.

This, I think, deserves some parsing as you will see the picture is murky. Take, for example, Tinley Park. I adduce that Tinley Park, like many of its neighbors, has tried to create walkable urbanism and failed not for a lack of effort. Tinley Park is geographically on the edge of Cook County. In fact a small portion of Tinley Park is in neighboring Will County. It is well connect to the big city. The I-80 interstate rolls through Tinley Park and will take you downtown with no tolls. Of course rush hour traffic on the Dan Ryan can be a grind but Tinley Park is also connected via the Metra. The Rock Island Line has two stops in Tinley Park. Both stations are fairly new, with the 80th street station being less than two years old, and declared to be the Taj Mahal of commuter train stations.

The "hut" that stood at the station since the 1970s is long gone, replaced by what Metra Chairman Brad O'Halloran on Monday called "the Taj Mahal" of the Metra system.

The station is the busiest on Metra's Rock Island Line, which stretches from Joliet to LaSalle Street in Chicago. The station borrows from and improves on the smaller station the village refurbished on Oak Park Avenue in 2003 that has won awards from architectural and transit groups and has become the central feature of Tinley Park's downtown district, said Village Trustee David Seamon.

The Oak Park Avenue station, in the heart of Tinley Park's historic, pedestrian friendly downtown, is a classic example of civic investment in transit-focused development, Mahmassani said.

Let's look closer at the Oak Park Avenue station.

Looking left there is, next to the parking lot, an empty lot. This parcel was to be a mixed use construction. Condos I think. If you enlarge the picture you can see the proposed renderings. Everything right up to the sidewalk.

Here we are, right up to the sidewalk. I'm not sure what used to be here. But this site has been in this state for years.

Despite these efforts, attempts at building more dense, urban areas in Tinley Park have failed, though not for lack of effort. This empty parcel of land is directly behind the Oak Park Avenue station. It was slated for redevelopment into mixed use condominiums. These pictures were taken in 2011 but currently the lot still stands empty. For years this project has sat waiting for funding; the locals long ago approved the density. Tinley Park tried to bring walkable urbanism to the south suburbs. Unfortunately for them the market did not follow.

This area, by the way, has a walk score of 61. Not terrible by suburban standards.

And while Chicago did very well last year, with home prices showing their biggest advance in 25 years, the south suburbs have done very poorly. Prices in many south suburbs have declined to 1990s levels.

This, I think, deserves some parsing as you will see the picture is murky. Take, for example, Tinley Park. I adduce that Tinley Park, like many of its neighbors, has tried to create walkable urbanism and failed not for a lack of effort. Tinley Park is geographically on the edge of Cook County. In fact a small portion of Tinley Park is in neighboring Will County. It is well connect to the big city. The I-80 interstate rolls through Tinley Park and will take you downtown with no tolls. Of course rush hour traffic on the Dan Ryan can be a grind but Tinley Park is also connected via the Metra. The Rock Island Line has two stops in Tinley Park. Both stations are fairly new, with the 80th street station being less than two years old, and declared to be the Taj Mahal of commuter train stations.

The "hut" that stood at the station since the 1970s is long gone, replaced by what Metra Chairman Brad O'Halloran on Monday called "the Taj Mahal" of the Metra system.

The station is the busiest on Metra's Rock Island Line, which stretches from Joliet to LaSalle Street in Chicago. The station borrows from and improves on the smaller station the village refurbished on Oak Park Avenue in 2003 that has won awards from architectural and transit groups and has become the central feature of Tinley Park's downtown district, said Village Trustee David Seamon.

The Oak Park Avenue station, in the heart of Tinley Park's historic, pedestrian friendly downtown, is a classic example of civic investment in transit-focused development, Mahmassani said.

Let's look closer at the Oak Park Avenue station.

The station is flanked by lot parking on all sides.

\

Across the street is a fairly walkable stretch of Oak Park Avenue. There is no parking in front except on street and everything is right up to the sidewalk. There are bars, restaurants, and even mixed use condominiums (the white balconies on the far right).

\

Looking left there is, next to the parking lot, an empty lot. This parcel was to be a mixed use construction. Condos I think. If you enlarge the picture you can see the proposed renderings. Everything right up to the sidewalk.

Here we are, right up to the sidewalk. I'm not sure what used to be here. But this site has been in this state for years.

Despite these efforts, attempts at building more dense, urban areas in Tinley Park have failed, though not for lack of effort. This empty parcel of land is directly behind the Oak Park Avenue station. It was slated for redevelopment into mixed use condominiums. These pictures were taken in 2011 but currently the lot still stands empty. For years this project has sat waiting for funding; the locals long ago approved the density. Tinley Park tried to bring walkable urbanism to the south suburbs. Unfortunately for them the market did not follow.

This area, by the way, has a walk score of 61. Not terrible by suburban standards.

Tuesday, September 23, 2014

The myth of exports

There is an old fable that goes something like "exports are the key to prosperity. America was much more prosperous and cities doing better when exports were higher." I want to caution against such a thin reading of economic history, as it can cause embarrassing mistakes. Take, for example, the assertion that everyone agrees that boosting exports is important and that building an export economy is more important for cities than building downtown apartments.

This fetishization of exports as a metric is pernicious because it can lead policy towards suboptimal goals. Especially for cities. Sometimes they are based on false assumptions as well. For example the above links are based on the false notion that "exports include both goods and services". This is false:

The OM-ZIP series can track export sales of states, metropolitan areas, and ZIP codes (at the three-digit level). Statistics are available for exports of merchandise only. No sub-national data currently exist on exports of services.

That's right, exports does not include services. So high service metros like New York, San Francisco, or Los Angeles are penalized in the export section. Metros that export manufactured goods and commodities like grains, oil, and machinery reflect well in the export section. An oil producing port of origin like New Orleans will therefore score well, despite the relative poverty of the metro. Especially because it is a port of origin for much of the goods that go down the Mississippi.

Generally, that person or entity is the U.S. seller, manufacturer, or order party, or the foreign entity while in the United States when purchasing or obtaining the goods for export

And yet this is the 21st century. The success of the tech and financial industries in spurring growth in places like San Francisco and New York suggests that the information age is at hand, and that exports as a metric of economic health is not as important as it once was. For many cities, building a downtown apartment IS more important than building up exports.

Good-bye commodities exports

Hello services

For cities like Chicago, where manufacturing exports have long waned, clinging to those remaining industries rather than fostering new 21st century industries is contraindicated.

This chart ranks things, but not per capita GDP, unemployment, purchasing power, or other relevant metrics of a metropolitan region's overall health.

This fetishization of exports as a metric is pernicious because it can lead policy towards suboptimal goals. Especially for cities. Sometimes they are based on false assumptions as well. For example the above links are based on the false notion that "exports include both goods and services". This is false:

The OM-ZIP series can track export sales of states, metropolitan areas, and ZIP codes (at the three-digit level). Statistics are available for exports of merchandise only. No sub-national data currently exist on exports of services.

That's right, exports does not include services. So high service metros like New York, San Francisco, or Los Angeles are penalized in the export section. Metros that export manufactured goods and commodities like grains, oil, and machinery reflect well in the export section. An oil producing port of origin like New Orleans will therefore score well, despite the relative poverty of the metro. Especially because it is a port of origin for much of the goods that go down the Mississippi.

Generally, that person or entity is the U.S. seller, manufacturer, or order party, or the foreign entity while in the United States when purchasing or obtaining the goods for export

And yet this is the 21st century. The success of the tech and financial industries in spurring growth in places like San Francisco and New York suggests that the information age is at hand, and that exports as a metric of economic health is not as important as it once was. For many cities, building a downtown apartment IS more important than building up exports.

Good-bye commodities exports

Hello services

For cities like Chicago, where manufacturing exports have long waned, clinging to those remaining industries rather than fostering new 21st century industries is contraindicated.

Rank

|

Metro Area

|

2012

|

| 1 | New Orleans-Metairie-Kenner, LA | 20209.1 |

| 2 | Houston-Sugar Land-Baytown, TX | 17778.0 |

| 3 | Seattle-Tacoma-Bellevue, WA | 14160.9 |

| 4 | San Jose-Sunnyvale-Santa Clara, CA | 14087.7 |

| 5 | Salt Lake City, UT | 13764.1 |

| 6 | Detroit-Warren-Livonia, MI | 12904.6 |

| 7 | Cincinnati-Middletown, OH-KY-IN | 9312.0 |

| 8 | Portland-Vancouver-Hillsboro, OR-WA | 8881.9 |

| 9 | Memphis, TN-MS-AR | 8522.5 |

| 10 | Miami-Fort Lauderdale-Pompano Beach, FL | 8304.9 |

This chart ranks things, but not per capita GDP, unemployment, purchasing power, or other relevant metrics of a metropolitan region's overall health.

Tuesday, September 2, 2014

The Downtown living era

The latest news comes from Cleveland. Downtown development is taking off and people are flocking to the center of Cleveland, a city once derided as the "mistake on the Lake".

More people are moving downtown: Between 2000 and 2014, the city's downtown residential population increased 60% to about 13,000. Over 3,100 apartments were created over that same period, according to the Downtown Cleveland Alliance, a nonprofit that works with downtown property owners, with another 2,200 units either under construction or planned.

Detroit, despite bankruptcy and depopulation in the periphery, is seeing a replete core.

Vacant units appear to be getting snapped up quickly. As of 2012, occupancy rates for rental units in central downtown and Midtown stood at 97% and 95%, respectively.

The same old story in Milwaukee, where the downtown core is booming.

Driven by growth in neighborhoods around downtown, Milwaukee's population grew by nearly 4,000 residents in the last two years, according to figures released Thursday by the U.S. Census Bureau.

I have long covered Chicago's Loop development.

As you can see from this map the neighborhood of downtown Chicago adjacent to Grant Park increased population by over 300%. This neighborhood historically has had low population, hence the phenomenal growth. In fact much of the Loop has been sparely populated and only in the recent years has space been repurposed residential.

I hesitate to construct a single narrative, but instead will attempt to weave several. One story is the tale of post-industrial cities repurposing the manufacturing core into residential districts. Another story is the changing preferences for walkable environments.

This is a paradigm shift in America, where a preference for downtown living germinated and stretches its acrospire. It happened first in New York, where Manhattan population declines reversed and eventually took hold in outer boroughs. The Rust Belt, once the acme of withered city cores, is finding a new reservoir of growth.

Another thread to weave in the narrative is rising inequality and housing. As inequality of income and wealth increases it does not surprise that inequality of housing concatenates.

In the Postwar era, the late 70s was a time of lower income inequality but also a time when many industrial cities experienced huge population losses. Chicago's biggest population loss as a percentage of the whole was during the 70s when it dipped 10.7%. The same story is true in Milwaukee, where the 1980 decennial showed a loss of 11.3%.

It is no surprise then, that demand for walkable neighborhoods has driven poverty out into the suburbs.

The number of suburban poor living in distressed neighborhoods grew by 139% since 2000, compared with a 50% jump in cities. Overall, the number of poor living in the suburbs has grown by 65% in the past 14 years—twice as much growth as in urban areas.

This is one reason why I avoid the "G" word. I suspect that many of the economic conditions were sown decades ago when people's preferences were different. Population and wealth moved to the suburbs. Now population, and even greater wealth, is returning. And so cities find themselves in a downtown development boom fueled by more money than that which built the postwar suburbs, and suburbs find themselves in a downturn as unprecedented as the mid-century decline of the American downtown.

Currently Chicago has plenty of empty real estate in and around downtown ripe for redevelopment. The city and many of its suburbs can easily build walkable, transit oriented development that can cater to the shifting demand for more rail and less bus transit. But eventually Chicago will exhaust its supply of this low hanging fruit of urbanism.

increasing demand for safe walkable neighborhoods is ineluctable

More people are moving downtown: Between 2000 and 2014, the city's downtown residential population increased 60% to about 13,000. Over 3,100 apartments were created over that same period, according to the Downtown Cleveland Alliance, a nonprofit that works with downtown property owners, with another 2,200 units either under construction or planned.

Detroit, despite bankruptcy and depopulation in the periphery, is seeing a replete core.

Vacant units appear to be getting snapped up quickly. As of 2012, occupancy rates for rental units in central downtown and Midtown stood at 97% and 95%, respectively.

The same old story in Milwaukee, where the downtown core is booming.

Driven by growth in neighborhoods around downtown, Milwaukee's population grew by nearly 4,000 residents in the last two years, according to figures released Thursday by the U.S. Census Bureau.

As you can see from this map the neighborhood of downtown Chicago adjacent to Grant Park increased population by over 300%. This neighborhood historically has had low population, hence the phenomenal growth. In fact much of the Loop has been sparely populated and only in the recent years has space been repurposed residential.

I hesitate to construct a single narrative, but instead will attempt to weave several. One story is the tale of post-industrial cities repurposing the manufacturing core into residential districts. Another story is the changing preferences for walkable environments.

This is a paradigm shift in America, where a preference for downtown living germinated and stretches its acrospire. It happened first in New York, where Manhattan population declines reversed and eventually took hold in outer boroughs. The Rust Belt, once the acme of withered city cores, is finding a new reservoir of growth.

Another thread to weave in the narrative is rising inequality and housing. As inequality of income and wealth increases it does not surprise that inequality of housing concatenates.

In the Postwar era, the late 70s was a time of lower income inequality but also a time when many industrial cities experienced huge population losses. Chicago's biggest population loss as a percentage of the whole was during the 70s when it dipped 10.7%. The same story is true in Milwaukee, where the 1980 decennial showed a loss of 11.3%.

It is no surprise then, that demand for walkable neighborhoods has driven poverty out into the suburbs.

The number of suburban poor living in distressed neighborhoods grew by 139% since 2000, compared with a 50% jump in cities. Overall, the number of poor living in the suburbs has grown by 65% in the past 14 years—twice as much growth as in urban areas.

This is one reason why I avoid the "G" word. I suspect that many of the economic conditions were sown decades ago when people's preferences were different. Population and wealth moved to the suburbs. Now population, and even greater wealth, is returning. And so cities find themselves in a downtown development boom fueled by more money than that which built the postwar suburbs, and suburbs find themselves in a downturn as unprecedented as the mid-century decline of the American downtown.

Currently Chicago has plenty of empty real estate in and around downtown ripe for redevelopment. The city and many of its suburbs can easily build walkable, transit oriented development that can cater to the shifting demand for more rail and less bus transit. But eventually Chicago will exhaust its supply of this low hanging fruit of urbanism.

increasing demand for safe walkable neighborhoods is ineluctable

Friday, August 22, 2014

Infrastructure innovations

Recently Matthew Yglesias took a survey of transit construction projects around the globe and found that construction costs in the US are extremely high.

In a way, the US has a problem with transit construction productivity. New York City's 1900 subway system cost 35 million dollars. In today's money that comes to 941 million dollars. The total length was approximately 20 miles. The cost per track mile was therefore about 47 million dollars a mile in 2014 dollars. Compare that to today's Second Avenue line, which is planned to build 8.5 miles of subway and looking at a cost of 4.5 billion dollars. That totals 529 million dollars a mile. Thus the cost of construction increased 482 million dollars a mile. More than 1,000% increase in costs.

Consider that since 1900 construction has been aided with the following innovations: diesel engines, laser guided drills, computer automation, and GPS for starters. Labor saving devices and productivity increases should have, in theory, reduced prices. For all the technical advances in surveying, planning, and building; costs have skyrocketed.

It is clear that in America there is no need for innovative financing for transit projects. Instead what is needed is innovative planning and construction that cuts costs significantly. If cities like Chicago wish to be globally competitive, they need to adopt construction practices that brings costs down to a level comparable with European cities.

The case for doing more is in fact strong. But it would be much stronger if the United States knew how to undertake cost-effective projects.

In a way, the US has a problem with transit construction productivity. New York City's 1900 subway system cost 35 million dollars. In today's money that comes to 941 million dollars. The total length was approximately 20 miles. The cost per track mile was therefore about 47 million dollars a mile in 2014 dollars. Compare that to today's Second Avenue line, which is planned to build 8.5 miles of subway and looking at a cost of 4.5 billion dollars. That totals 529 million dollars a mile. Thus the cost of construction increased 482 million dollars a mile. More than 1,000% increase in costs.

Consider that since 1900 construction has been aided with the following innovations: diesel engines, laser guided drills, computer automation, and GPS for starters. Labor saving devices and productivity increases should have, in theory, reduced prices. For all the technical advances in surveying, planning, and building; costs have skyrocketed.

It is clear that in America there is no need for innovative financing for transit projects. Instead what is needed is innovative planning and construction that cuts costs significantly. If cities like Chicago wish to be globally competitive, they need to adopt construction practices that brings costs down to a level comparable with European cities.

Monday, July 14, 2014

Following the housing problem

I previously covered the housing crunch facing big cities. The problem is starting to become widespread.

The US is facing a new housing crisis. No, it has nothing to do with subprime mortgages or bloated home equity balances. This time the nation is dealing with shortages of rental housing, a problem that will become increasingly acute in years to come and may result in a material drag on economic growth.

Indeed we are already seeing it now. Younger adults are buying homes infrequently.

The US is facing a new housing crisis. No, it has nothing to do with subprime mortgages or bloated home equity balances. This time the nation is dealing with shortages of rental housing, a problem that will become increasingly acute in years to come and may result in a material drag on economic growth.

Indeed we are already seeing it now. Younger adults are buying homes infrequently.

Just 36% of Americans under the age of 35 own a home, according to the Census Bureau. That's down from 42% in 2007 and the lowest level since 1982, when the agency began tracking homeownership by age.

They are also living in their parents' home more frequently.

Due to high unemployment and sluggish wage growth, lots of young people who aren't in school don't have very much money in their pockets. And yet even though young people have less money today, rents are higher and mortgage lending standards are tighter. Higher costs plus lower incomes = growing need to economize, so more people are living with their parents.

We see younger adults with lower paying jobs and less savings, which is driving down demand for homes. Thus, supply is not increasing quickly; as reflected in depressed construction numbers. New home prices won't fall below construction costs, so there is a price floor. So the supply rises to meet a paltry demand.

If the problem were purely supply constrains we would see rapidly rising home prices. And while that is true in some localities it isn't happening across the Midwest. We are seeing rising home prices, but only in places truly constrained in increasing supply and facing rising demand like San Francisco and New York. Other cities have rising demand and unconstrained supply, like Houston. And while downtown Detroit and Chicago are seeing rising prices in some desirable neighborhoods, they aren't seeing the aggregate demand increases that Dallas is experiencing. Indeed Dallas prices are at record highs, and Chicago is still off the peak.

For a city like Chicago, which is seeing rising rents despite low population growth, the question is would a resurgence of demand among younger Americans cause prices to skyrocket? And if they did, would rising prices ignite a construction boom in a city with rather depressed new construction starts?

They are also living in their parents' home more frequently.

Due to high unemployment and sluggish wage growth, lots of young people who aren't in school don't have very much money in their pockets. And yet even though young people have less money today, rents are higher and mortgage lending standards are tighter. Higher costs plus lower incomes = growing need to economize, so more people are living with their parents.

We see younger adults with lower paying jobs and less savings, which is driving down demand for homes. Thus, supply is not increasing quickly; as reflected in depressed construction numbers. New home prices won't fall below construction costs, so there is a price floor. So the supply rises to meet a paltry demand.

If the problem were purely supply constrains we would see rapidly rising home prices. And while that is true in some localities it isn't happening across the Midwest. We are seeing rising home prices, but only in places truly constrained in increasing supply and facing rising demand like San Francisco and New York. Other cities have rising demand and unconstrained supply, like Houston. And while downtown Detroit and Chicago are seeing rising prices in some desirable neighborhoods, they aren't seeing the aggregate demand increases that Dallas is experiencing. Indeed Dallas prices are at record highs, and Chicago is still off the peak.

For a city like Chicago, which is seeing rising rents despite low population growth, the question is would a resurgence of demand among younger Americans cause prices to skyrocket? And if they did, would rising prices ignite a construction boom in a city with rather depressed new construction starts?

Sunday, June 1, 2014

Desirable walkability

Recently a story about Detroit made some waves because it bucked the trend of tales of decline. Instead it focused on Detroit's rising rents:

Karen Schultz lived in a seven-room apartment in Midtown's Cass Corridor for 35 years. She was kicked out in late 2013. "It was a really nice building next to Wayne State and the landlord is moving students in and out and increasing the rent," said the 60-year-old retired police department psychologist. She now pays $926 a month for a three-bedroom, up from $815 in her old place. She thinks she may have to move in with her daughter and her three grandchildren, who were also priced out of the old building.

This concatenates with the rather contradictory story about Detroit's expensive plan to remove derelict homes:

A task force convened by the Obama administration issued the most detailed study yet of blight in Detroit on Tuesday and recommended that the city spend at least $850 million to quickly tear down about 40,000 dilapidated buildings, demolish or restore tens of thousands more, and clear thousands of trash-packed lots. It also said that the hulking remains of factories that dot Detroit, crumbling reminders of the city’s manufacturing prowess, must be salvaged or demolished, which could cost as much as $1 billion more.

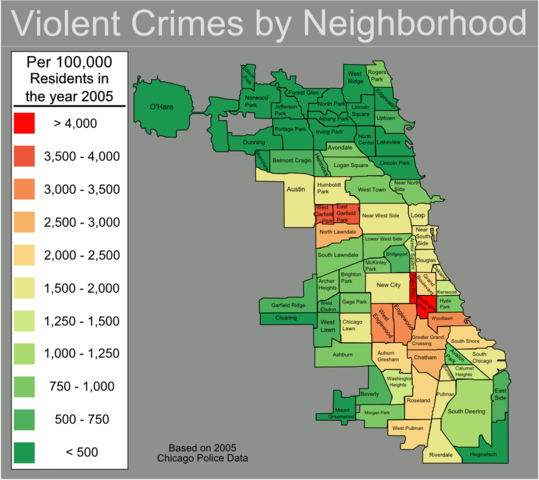

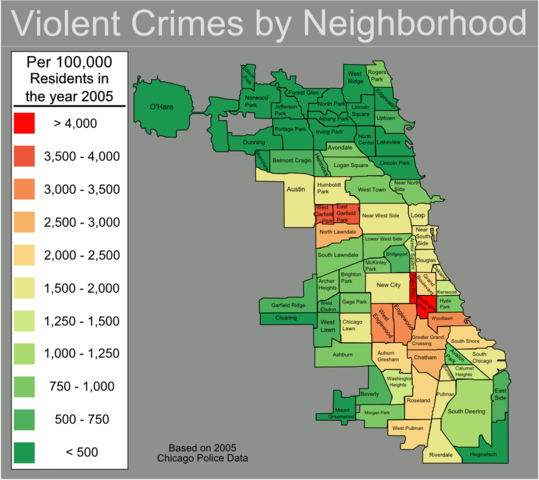

This begs the question "Why are some areas of the city rising in value while some areas continue to free fall?" But a closer examination shows a rather obvious correlation. First, the big picture.

It is unsurprising that the areas with fewer violent crimes are doing better than the high homicide areas. And indeed you can compare this map with the demographic map of Detroit and see something of an overlap where people are leaving.

The overlap is no surprise. But the crime map doesn't tell the whole story. One of the neighborhoods highlighted with rising rents is Cass Corridor in Midtown. This area has a walkscore of 91. Compare that to some of the neighborhoods with rising vacancy rates. Take, for example, this area of Palmer Woods, with a comparable homicide rate and an increasing vacancy rate: walkscore 42.

Continue your tour of Detroit to the Southeast side, another region where the crime rates are comparatively low but the vacancy rates are increasing. There you find a walk score of 45. While it is no surprise that the regions of the city with higher homicide rates have higher vacancy increases, the walk score factor has been surprisingly absent in the recent brouhaha over Detroit's multifaceted housing market.

In fact I encourage you to take a trip around Detroit with the walk score and see the correlation between decreasing vacancy and high walk score. This high vacancy neighborhood on the Southwest side, for example, has a walk score of 48. And another, this in the lower crime and lower vacancy neighborhood of Elmwood Park has a walk score of 69.

The areas of the city that seem to be doing the best are areas with a higher walk score and lower homicide rate. And the correlation between lower homicides and higher walk scores is evident as well. This is an important point that is missing in the analysis of many urbanists. Rather than making facile comparisons to globalization or ignoring market preferences for walkability altogether, urbanists should be connecting the dots. I've already highlighted the low rate of driving, car ownership, and drivers licenses of the youngest cohort. A simple conclusion is that increasing demand for safe walkable neighborhoods is ineluctable. And indeed such observations are omnipresent, even in highly blighted Detroit.

It is strange to suggest that people priced out of a low crime high walkable area simply move to a higher crime and lower walkable area as a reasonable solution to the problem! It is strange to make a moral judgement about market preferences.

Urbanists are not seeing the nuance in the demand and supply issues at the locus. Failure to differentiate between quality of housing stock and neighborhood characteristics has lead many urbanists to mistake demand issues for supply issues, or simply dismiss the demand issues. Indeed Detroit serves as a monolithic example of inelasticity in both supply and demand. This has lead to moralistic pablum such as referring to a retired police psychologist as a young urbanist, a part of the global workforce, or an entitled grouser rather than looking at empirical evidence. We could observe from the data provided that low crime high walkable neighborhoods in Detroit is an inelastic good, with a demand that is increasingly inelastic as well. Again, with the demographic numbers on younger Americans the demand elasticity is unsurprising. The pace of supply increases of low crime highly walkable neighborhoods is a subject well worn for good reason.

This issue is transferable to other cities. Take Chicago.

In Chicago the pattern looks familiar. This Englewood neighborhood has a walkscore of 71. Compared to the burgeoning Wicker Park area where the score clocks in at 89. As you can see, Wicker Park has both a lower violent crime rate and a higher walk score. If one continues this series with some of the sententious alternatives to Wicker Park you find the following:

Woodlawn: 55

South Shore: 75

Bronzeville: 72

Austin: 74

Note that these suggest alternative neighborhoods all have significantly higher violent crime rates as well as lower walk scores.

Indeed one author even went so far as to suggest Garfield Park as a reasonable alternative to Lakeview. Garfield Park is home to one of the most dangerous neighborhoods in America. Shamefully, some urbanists think violent crime is an unimportant statistic!

Karen Schultz lived in a seven-room apartment in Midtown's Cass Corridor for 35 years. She was kicked out in late 2013. "It was a really nice building next to Wayne State and the landlord is moving students in and out and increasing the rent," said the 60-year-old retired police department psychologist. She now pays $926 a month for a three-bedroom, up from $815 in her old place. She thinks she may have to move in with her daughter and her three grandchildren, who were also priced out of the old building.

This concatenates with the rather contradictory story about Detroit's expensive plan to remove derelict homes:

A task force convened by the Obama administration issued the most detailed study yet of blight in Detroit on Tuesday and recommended that the city spend at least $850 million to quickly tear down about 40,000 dilapidated buildings, demolish or restore tens of thousands more, and clear thousands of trash-packed lots. It also said that the hulking remains of factories that dot Detroit, crumbling reminders of the city’s manufacturing prowess, must be salvaged or demolished, which could cost as much as $1 billion more.

This begs the question "Why are some areas of the city rising in value while some areas continue to free fall?" But a closer examination shows a rather obvious correlation. First, the big picture.

It is unsurprising that the areas with fewer violent crimes are doing better than the high homicide areas. And indeed you can compare this map with the demographic map of Detroit and see something of an overlap where people are leaving.

The overlap is no surprise. But the crime map doesn't tell the whole story. One of the neighborhoods highlighted with rising rents is Cass Corridor in Midtown. This area has a walkscore of 91. Compare that to some of the neighborhoods with rising vacancy rates. Take, for example, this area of Palmer Woods, with a comparable homicide rate and an increasing vacancy rate: walkscore 42.

Continue your tour of Detroit to the Southeast side, another region where the crime rates are comparatively low but the vacancy rates are increasing. There you find a walk score of 45. While it is no surprise that the regions of the city with higher homicide rates have higher vacancy increases, the walk score factor has been surprisingly absent in the recent brouhaha over Detroit's multifaceted housing market.

In fact I encourage you to take a trip around Detroit with the walk score and see the correlation between decreasing vacancy and high walk score. This high vacancy neighborhood on the Southwest side, for example, has a walk score of 48. And another, this in the lower crime and lower vacancy neighborhood of Elmwood Park has a walk score of 69.

The areas of the city that seem to be doing the best are areas with a higher walk score and lower homicide rate. And the correlation between lower homicides and higher walk scores is evident as well. This is an important point that is missing in the analysis of many urbanists. Rather than making facile comparisons to globalization or ignoring market preferences for walkability altogether, urbanists should be connecting the dots. I've already highlighted the low rate of driving, car ownership, and drivers licenses of the youngest cohort. A simple conclusion is that increasing demand for safe walkable neighborhoods is ineluctable. And indeed such observations are omnipresent, even in highly blighted Detroit.

It is strange to suggest that people priced out of a low crime high walkable area simply move to a higher crime and lower walkable area as a reasonable solution to the problem! It is strange to make a moral judgement about market preferences.

Urbanists are not seeing the nuance in the demand and supply issues at the locus. Failure to differentiate between quality of housing stock and neighborhood characteristics has lead many urbanists to mistake demand issues for supply issues, or simply dismiss the demand issues. Indeed Detroit serves as a monolithic example of inelasticity in both supply and demand. This has lead to moralistic pablum such as referring to a retired police psychologist as a young urbanist, a part of the global workforce, or an entitled grouser rather than looking at empirical evidence. We could observe from the data provided that low crime high walkable neighborhoods in Detroit is an inelastic good, with a demand that is increasingly inelastic as well. Again, with the demographic numbers on younger Americans the demand elasticity is unsurprising. The pace of supply increases of low crime highly walkable neighborhoods is a subject well worn for good reason.

This issue is transferable to other cities. Take Chicago.

In Chicago the pattern looks familiar. This Englewood neighborhood has a walkscore of 71. Compared to the burgeoning Wicker Park area where the score clocks in at 89. As you can see, Wicker Park has both a lower violent crime rate and a higher walk score. If one continues this series with some of the sententious alternatives to Wicker Park you find the following:

Woodlawn: 55

South Shore: 75

Bronzeville: 72

Austin: 74

Note that these suggest alternative neighborhoods all have significantly higher violent crime rates as well as lower walk scores.

Indeed one author even went so far as to suggest Garfield Park as a reasonable alternative to Lakeview. Garfield Park is home to one of the most dangerous neighborhoods in America. Shamefully, some urbanists think violent crime is an unimportant statistic!

Subscribe to:

Posts (Atom)